The thought of your employer cutting your pay can be unsettling. It raises questions about fairness and your financial security. Many workers wonder if such a move is even legal. While it feels wrong, there are specific situations where an employer can legally reduce your salary.

This article will break down when your pay can change, how different employee types are affected, and what you should do if your employer proposes a pay change. Understanding your rights is key to protecting your income.

When Can an Employer Legally Lower Your Salary?

1. Changes to Employment Terms

Your job is an agreement between you and your employer that sets your salary and duties.

- New Hires and Offer Letters

Your initial salary is typically outlined in your offer letter. Once accepted, it becomes binding—provided it meets minimum wage requirements. - Existing Employees: Agreement to New Terms

Employers may propose a lower salary, but you generally must consent. Refusal could result in termination. - Written Employment Contracts

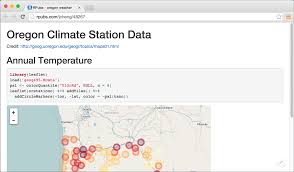

Contracts often specify how and when salaries can change. Always refer to yours for details on pay adjustments. For legal insight, see this guide on pay reductions Wenzel Fenton Cabassa, P.A..

2. Changes to Job Duties or Position

Your salary generally reflects your role. A change in responsibilities can justify a change in pay.

- Demotions and Role Changes

If you’re moved to a less demanding position, your salary may be reduced. - Reduction in Hours or Responsibilities

Fewer hours or less critical tasks can lead to decreased compensation.

3. Economic Downturns and Business Necessity

Salary cuts can be a measure to avoid layoffs during tough times.

- Company-Wide or Departmental Adjustments

Companies may reduce pay broadly to preserve jobs. - Impact on Commission or Bonus Structures

Variable pay (commissions, bonuses) may decrease—but this isn’t a direct salary reduction.

4. Legal Protections and Minimum Wage Laws

Even when reductions are legally permitted, certain protections still apply:

- Minimum Wage Compliance

Your new pay must stay above federal, state, or local minimum wage levels. - “Use-It-or-Lose-It” Deductions (for Exempt Employees)

Employers generally cannot dock pay for partial-day absences—but can reduce salary levels prospectively under economic necessity, per the Department of Labor DOL+1. - Overtime and Non-Exempt Employees

If you’re non-exempt and paid hourly, the reduction is valid only if overtime is still paid when applicable and minimum wage laws are met.

What Employees Should Know and Do

1. Review Your Employment Contract and Company Policies

- Revisit your offer letter and contract for terms about pay changes.

- Check the employee handbook for procedural details.

2. Key Considerations Before Accepting a Reduction

- Is the Reduction Legal? Verify if it follows applicable employment laws. A detailed article on pay-cut legality is also helpful RM Legal GroupOnTheClock.

- Impact on Benefits and Future Earnings such as 401(k) contributions, promotions, and long-term career trajectory.

- Explore Alternatives, like reduced hours or temporary pay freezes.

3. Seek Clarification and Document Everything

- Always ask for a written explanation of the new terms.

- Keep copies of all notices, agreements, or refusals.

4. When to Seek Professional Advice

- Consult an Employment Lawyer if you suspect your rights are violated.

- File a Wage Complaint with state or federal labor departments if legal thresholds are breached.

- Evaluate Your Options: Staying may not always be best—sometimes seeking new employment is wiser.

10 Key Takeaways to Keep in Mind

- Employers can’t reduce pay retroactively—only moving forward. RM Legal GroupThe Balance

- Working agreements may limit an employer’s ability to cut pay. Wenzel Fenton Cabassa, P.A.SuperLawyers.com

- Salary cuts tied to job changes (like demotion) may be permissible.

- Pay reductions must respect minimum wage and overtime laws.

- Exempt employees can’t have partial-day pay docked arbitrarily. DOL+1

- Most states require advance notice before a pay cut takes effect. business.comlabor.mo.gov

- Non-exempt employees must still be paid for overtime post-reduction.

- Never accept a pay cut without a clear, written explanation.

- Illegal reasons like discrimination or retaliation are not acceptable grounds. SuperLawyers.com

- If unsure, seek legal or government aid—your pay is your right.